Have you also been wondering how to get HDFC bank debit card EMI on Amazon and Flipkart in 2025?

Getting EMI’s on HDFC Debit Cards was never this easier with Amazon and Flipkart. You’re now only one SMS away from figuring out if you’re eligible to avail this offer!

Gone are the days when purchasing things like laptops, televisions, washing machines, cameras, mobile phones etc on monthly installments used to be a tedious task, required endless archives and standing in queues. Further, it used to be a compulsion to own a credit card so as to have the capacity to benefit EMI’s but oh! how circumstances are different now, on account of banks like HDFC which presently give you a chance to purchase all that you need with EMI’s on Debit Cards! Indeed, you read it right! EMI on debit cards is presently especially conceivable and you can shop immediately from Amazon and Flipkart using it.

So, first things first, what exactly is an EMI?

An Equated Monthly Installment, know more popularly as an EMI, is a settled installment sum made by a borrower to a loan specialist at a predefined date each logbook month. Equated regularly scheduled payments are utilized to satisfy both interest and principal every month so that over a predefined period of time, the loan taken is satisfied in full.

What is Debit Card EMI ?

Well, the entire concept and process of buying things on EMI remains the same here except for the fact that now it can be availed on one’s Debit Card as well instead of Credit Cards.

Why Debit Card EMI, though? As per information provided by the Reserve Bank of India, a very large number of online shoppers do not hold a credit card, to be precise only 3.14 crore customers hold one, while 79.38 crore customers hold a debit card only. It was time things changed. So, Flipkart and Amazon took the initiative to enable online shoppers to purchase things on their debit cards as well.

So now, our next question should be if one can get an EMI on their HDFC debit cards, right?

Yes, you can get an EMI on your HDFC Debit Card. Read on to find more!

How does HDFC debit card EMI works?

While, at the time of the procurement, your financial balance won’t be deducted. Instead, your bank will have a pre-endorsed additional facility which will be utilized for this installment.

Anyway, you may see a Debit and Credit exchange in your record when your loan is sanctioned. Post this, you will have to pay the regularly scheduled installments to your bank according to the EMI choice chosen by you.

But are you eligible to get an EMI on your HDFC debit card?

Here’s an eligibility check that shall work as

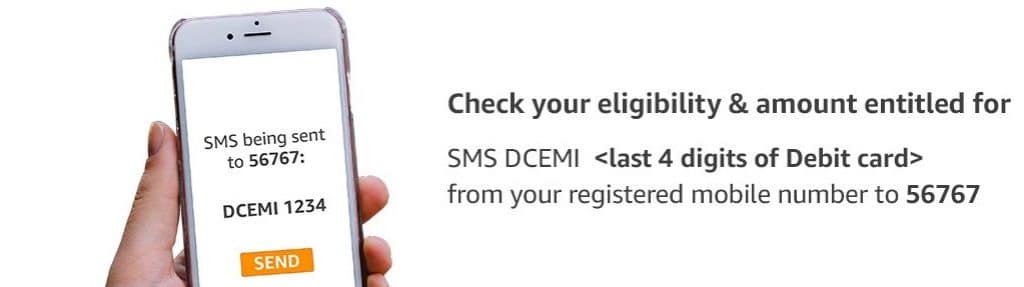

To know if you’re eligible for availing an EMI on your debit card simply send an SMS, stating, “

How can you avail HDFC bank debit card EMI on Amazon & Flipkart?

Step

Step 2: Go to the product page that you wish to purchase.

Step 3: Now, once you are on the product page, click on the option to explore EMI options.

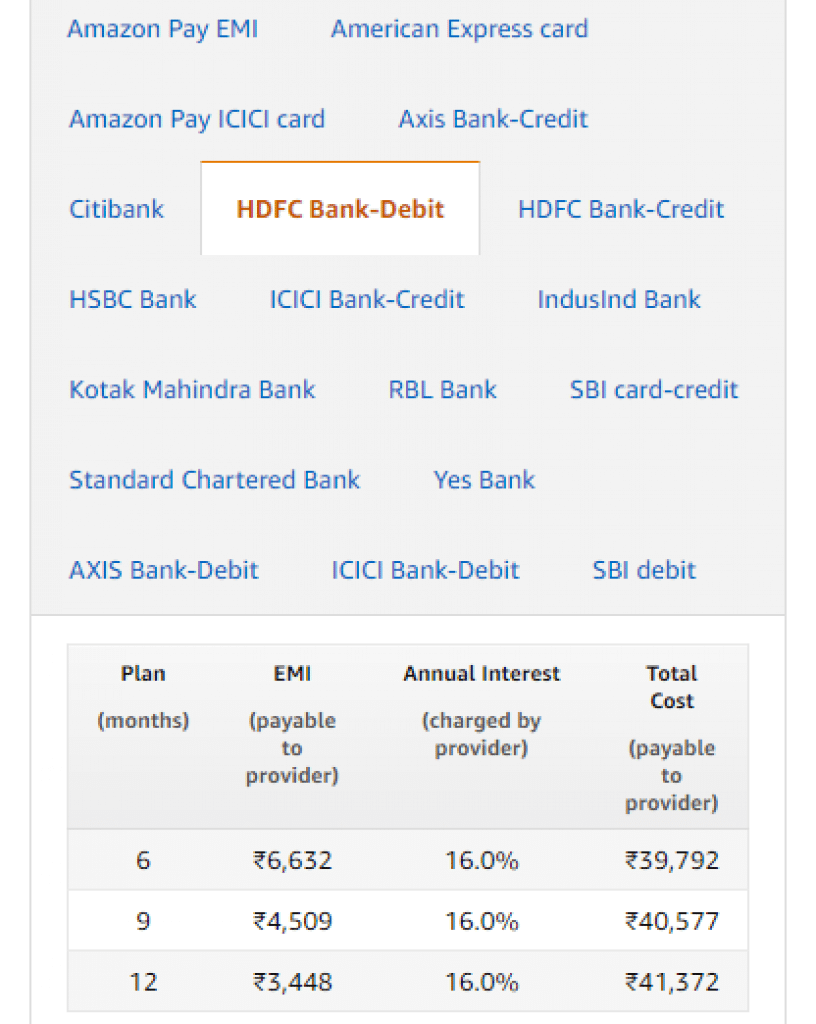

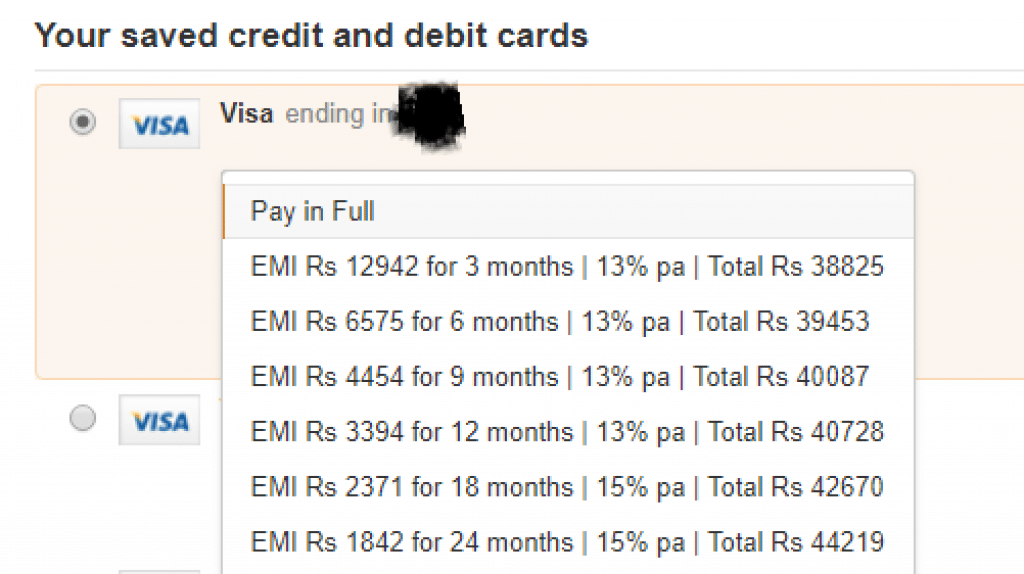

Step 4: Under EMI options check for HDFC Debit Card eligibility.

Step 5: When you reach the Payment page, select the EMI option already given there.

Step 6: After selecting the EMI option, add your HDFC debit card and select the best EMI plan according to your needs.

Step 7: Continue with the transactions and you’d be done.

Easy, ain’t it?

I’m also discussing a few FAQs here, just in case you need more help:

When does the first EMI start?

Credit accounts booked month to month between first to nineteenth will have the EMI installment due date as fifth of following month and Loan accounts booked month to month between 21st to 31st will have the EMI installment due date as fifth of consequent after month.

How does the EMI payback function?

Your concerned bank auto-empowers the standing guidance on your SB A/C to empower charge of regularly scheduled installments for EMI. It would be ideal if you ensure you keep adequate amount in your SB A/C to cover for the EMI sum. In the event that you wish to re-pay the sum early, you can contact your back to close the EMI , yet just post 3 month to month EMIs are paid.Your bank may demand extra charges for pre-conclusion of the credit.

Is there a minimum purchase value to avail EMI on HDFC debit card?

Yes, there is a minimum purchase value of INR 10,000 on selected products to avail EMI on HDFC products.

Can I get a no cost EMI on products if I pay using HDFC debit card?

This facility is available on selected products. Given that the product you choose has as option for no cost EMI, it’ll be displayed on the on the Payment page once you choose HDFC Debit Card as the payment option.

What happens when I cancel the product for which I opted for EMI?

If at all your product is eligible for cancellation or return, you can return it within 30 days of the purchase and your EMI shall be cancelled

by the bank.

I hope we solved all your queries regarding HDFC debit card EMI procedure, eligibility, availability and more. In case you shall have any more queries, you can reach out to us in the comments section below to leave your remarks/suggestions, and we shall assist you with the same.

Until then, stay tuned and keep reading!

Immediate I have required Samsung branded mobile phone through EMI facility by our HDFC Bank debit Card, So please arrange it…!